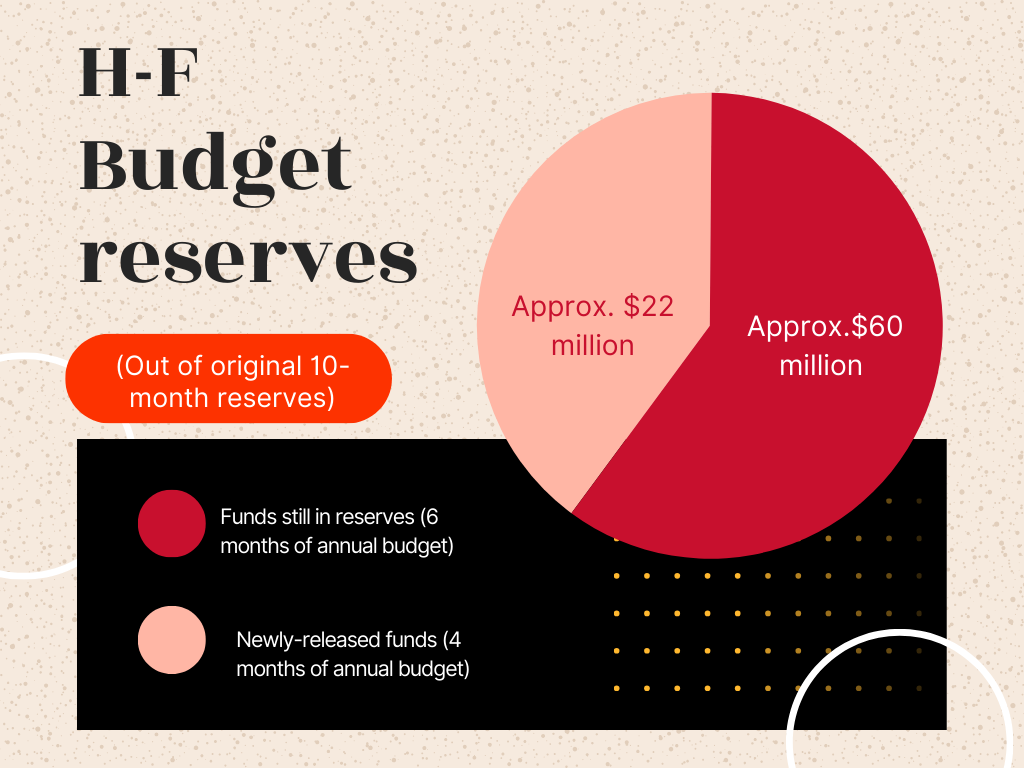

As of March 19, four months of H-F’s budget reserves, or approximately $22 million, have been released.

Reserves can be viewed as a “savings account” for the school and, according to principal Clinton Alexander, can be used for one-time capital improvements such as a roofing project or B building renovations. This school originally held 10 months, or roughly $60 million in reserves, to receive a triple-A bond rating, the highest rating possible.

Illustrate why we might need to tap into our savings.

With more funds available for use on capital projects, H-F will not have to pay with bonds, which issue unnecessary debt and require more tax dollars, and will instead be able to utilize these newly-released funds.

The purpose is to prevent the school from having to take out loans for these types of projects. With a high bond rating, the school pays lower interest rates on bonds when reserves cannot be used, according to Superintendent Scott Wakeley.

The newly released funds will likely be used for the Science Building and clothing construction classes, but also 14 to 15 other capital projects that should likely be completed within the next five to 10 years, according to chief school business official Lawrence Cook.

Plans are in place to invest the money in school projects across 5-10 years. In the immediate future, H-F plans to use some funds for flooring projects in South and North Buildings, brighten the school’s lights and renovate the library, T-Labs and Mall Building.

The school’s use of money in reserve is a normal right of the school, and even required by the State of Illinois, however holding 10 months of reserves was an abnormal choice made by the school.

Cook, who has been the business manager for H-F for five years, said, “The question I always asked was, why 10 months?” While only three months of reserves are required by the State of Illinois, he assumed this 10-month reserve policy was to achieve the highest bond rating possible, however, six months of reserves are all that’s required for the highest bond rating.

The State rating–which is separate from bond ratings and does not affect interest rates on bonds–requires 10 months of reserves for the highest rating, but keeping that much in reserves prevents school dollars from being usable. If the school kept 10 months of reserves, H-F would have to rely on loans to pay for large capital projects, which would issue more debt.

As Cook explained, “In layman’s terms, it’s either use what’s in your savings if you have an abundance in savings, if you can afford to do it, versus going out and putting things on credit and then you have to pay interest on it.”

Ultimately, this decision will lead to more efficient use of school funds and tax dollars by the H-F administration and is a step towards an improved school environment