J.P. Morgan’s chief economist put the odds of the U.S. heading into a recession at 40%. A March CNBC Fed Survey of 32 experts, including fund managers, strategists and analysts, put the probability at 36%.

While these statistics do not ensure anything, concerns that the U.S. economy could reach the point of a recession are not coming out of thin air. To truly evaluate the probability, it is first necessary to identify the causes and indicators of recession.

A recession can be defined as two consecutive quarters of a constantly decreasing Gross Domestic Product (GDP), according to economics teacher Hailey Baumstein. In other words, for six or more months, unemployment rises and economic output declines.

“Things that we have to watch out for are a decrease in overall spending,” Baumstein said. This includes both consumer and government spending, and “right now, a lot of people are losing government jobs, so that is a massive decrease in government spending.”

She continued that business shutdowns and major layoffs are also serious red flags.

“So far, we haven’t heard about layoffs at a lot of companies,” economics teacher Nick Anello stated. “Once those would start to trickle in, if, like, Microsoft is laying off 500 workers and Apple is laying off 1,000, once we see that string, that may pick up the feelings for recession.”

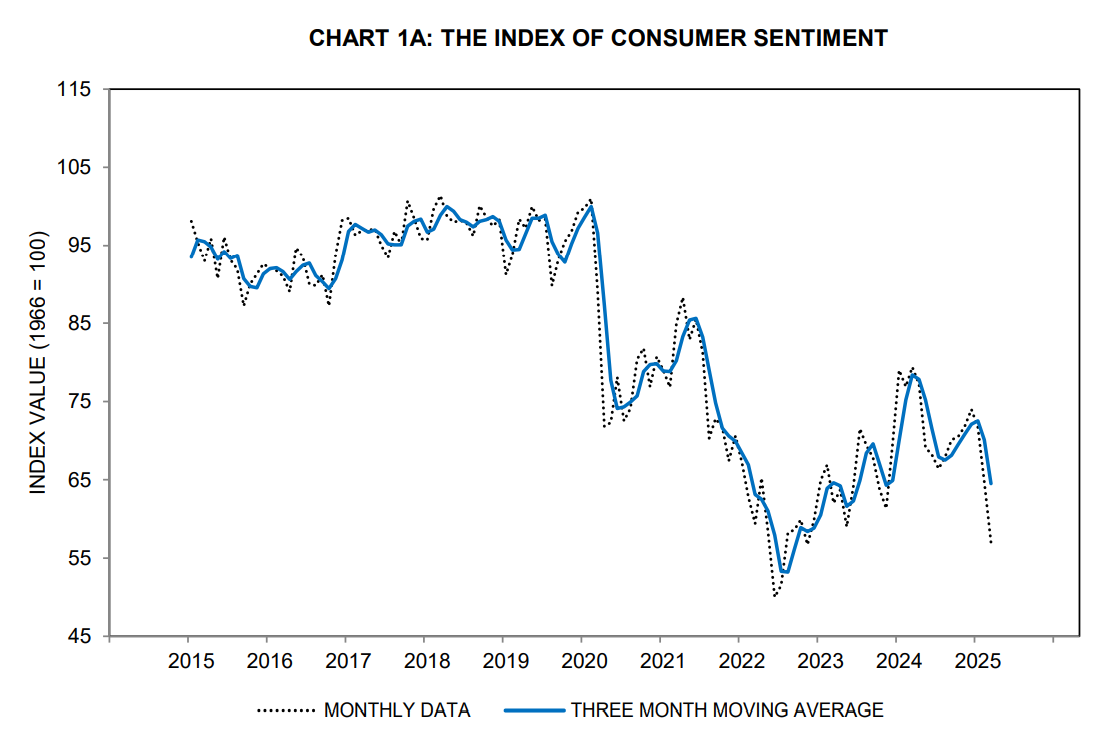

One indicator economists use to predict recessions, according to Anello, is the University of Michigan Sentiment Index, which measures consumer confidence in the economy.

According to the index’s April preliminary report, “Consumer sentiment fell for the fourth straight month, plunging 11% from March. This decline was, like last month’s, pervasive and unanimous across age, income, education, geographic region, and political affiliation.”

Anello speculated that this low confidence is caused by uncertainty with the new presidential administration.

With this new administration, “everything seems volatile,” Anello said. “It’s just fear of the unknown.”

Consumers’ confidence in the economy is reflected in their spending. As Anello stated, “When people start to change how they feel, they change how they spend. So if people are pessimistic about the future, they’re likely to spend less, which means saving more just in case they lose their job, and need to rely on that savings.”

However, this indicator is imperfect. Consumer spending is just one part of the bigger picture, and how consumers feel about the economy often contrasts with other measures of economic health. According to Anello, job reports are actually looking strong.

“The word ‘resilient’ in our labor market has been used over the last several months where, even as inflation has been falling, unemployment has stayed pretty steady,” Anello said. “So, from the jobs aspect, the actual jobs being created in the last month, those numbers are still strong.”

According to Baumstein, “the big X-factor in our GDP is trade.” President Donald Trump has made sweeping changes in international trade, more specifically by implementing steep tariffs.

“Ultimately, the goal of all this is to encourage people to buy American-made goods, but we just don’t have the manpower right now to even produce these goods,” Baumstein expressed.

As the U.S. has significantly more imports than exports, problems arise when demand exceeds the supply available domestically.

On the other end of the spectrum, if nations “are doing retaliatory tariffs on our goods, we’re making less money in terms of exports,” Baumstein stated.

However, as Trump has put most tariffs on a temporary pause, it is difficult to predict the extent to which these tariffs will affect American consumers, and their longevity.

As Baumstein stated, “these policies are changing every single day, and the economy’s not an exact science, so if we institute a new policy tomorrow, this whole trajectory is trash and we have to start all over.”

The stock market is another indicator of economic health, and it is not in good condition right now.

The stock market, as Anello stated on April 7, has “had a terrible last week, and so people especially looking to retire this year are going to find it very difficult because, if they had $500,000 saved up a month ago, that may only be worth, $400,000,” making it significantly more difficult to retire.

Dips in the stock market also often translate to investors spending more conservatively, leading to a decline in funding for businesses.

Given all of these factors, compared to J.P. Morgan’s chief executive’s prediction of a 40% chance that the U.S. is moving towards a recession and the CNBC poll’s prediction of 36%, Anello “would have guessed higher.”

However, he concedes that “people who are that plugged in [as the experts making those predictions] know much better than I do.”

“It takes a lot to move into recession,” Anello said. While some instances may be a sudden collapse, for example the pandemic-induced recession in 2020, the economy is a cycle which will always ebb and flow.

He likened the economy to a freight train, explaining that “because there are so many cars, once you get that thing moving like it’s been, it takes a lot for it to actually stop.”